Eleven checkpoints in the Certificate of Bookkeeping Timeliness

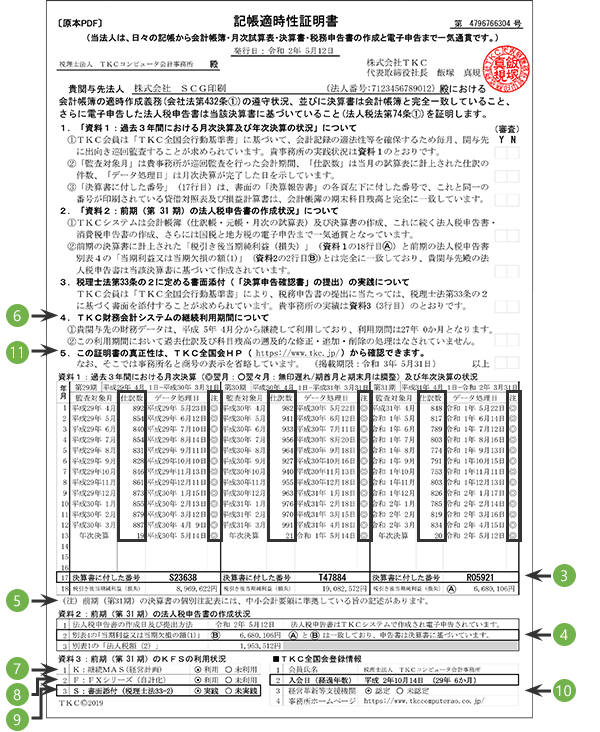

- Number of "◎" marks in the "Note" column

As a general rule, field auditing and monthly account closing are to be conducted monthly on the accounting books and records of transactions which the client has prepared in the previous month. The "◎" mark is given to the month in which the client complies with this rule. The Certificate of Bookkeeping Timeliness keeps the history of the giving of this mark, or absence of it, for the preceding 36 months. - Number of journal entries

The "number of journal entries" represents that of transactions subject to the monthly field auditing and monthly account closing.

Confirmation of the number of journal entries throughout the fiscal year and its comparison with that of the previous year provide an estimate of the accuracy of the data in the monthly account closings. The less the number of journal entries is in the yearly account closing, the more accurate are the monthly account closings. - The numbers given to the financial statements

TKC gives a unique number to each set of financial statements at the lower left side of each page, to certify the consistency between the financial statements and the accounting books. This confirms the balance at the end of year on the financial statements and that of the accounting books, in all of the charts of the accounts. - The fact that the financial statements and the income tax returns match

The certificate testifies that the amount in "the profit/loss after tax for the current period" in the financial statements coincides with that in "income or loss for the period" in Schedule 4 of the corporate income tax return. This confirms that the tax return is based on the financial statements. If they do not coincide, the Certificate of Bookkeeping Timeliness will not be issued. - Compliance with the General Accounting Standard for SMEs (or the Guidelines for SMEs)

The certificate confirms that the "table of individual notes" in the financial statements of the previous fiscal year has the description that the statements comply with the General Accounting Standard for SME Accounting (or the Guidelines for SMEs). - Period of continuous use of the TKC Systems

Those clients who have been using the TKC Systems for a long time and have many "◎" marks in the "Note" column in ① above, may well be among the companies under reliable management. TKC data centers have up to ten years of accounting data and allow for their verification at any time. - Existence of mid (or short) term management plan

The Continuous MAS System of TKC allows for confirming the existence of a mid (or short) term management plan which serves as the guideline for management improvements. - Existence of the system for self-accounting practices

The certificate confirms whether the client uses the Strategic Financial Information System (FX Series), an enterprise control accounting system offered by TKC which enables managers to accurately grasp the progress of management plans and supports appropriate decision making. - The existence of supporting documents, etc., prescribed in Item 1, Article 33-2 of the Certified Public Tax Accountant Act

The certificate confirms that the TKC member, at the time of filing the corporate income tax return, has submitted supporting documents that clarify the "items the member calculated, organized, or for which the member has been consulted" and "makes the statement about the appropriateness of the tax returns." - Whether the retained certified public tax accountant is approved to act as a "support institution for management innovation"

The certificate confirms whether the certified public tax accountant retained by the client is approved to act as a support institution for management innovation in accordance with the Act on Support for Strengthening Management Functions for SMEs. - Authenticity of the certificate

The authenticity of the certificate can be verified by visiting the website of the TKC group at https://www.tkc.jp/.

In doing so, please enter the "date of issue" and "serial number" from the upper right side of the certificate.