Enhancing capabilities for giving accounting guidance and for supporting companies in their survival and development

For SMEs to strengthen "financial management capabilities" and "funding capabilities", it is indispensable to "enhance their managers' ability to grasp and explain about the management status" as well as to "establish the system for managing their finances at any time during the accounting period."

We at TKCNF support SMEs in carrying out such tasks in cooperation with local financial institutions and organizations for supporting SMEs.

Increasing expectations for Certified Public Tax Accountants (CPTAs) from society

The Small and Medium-sized Enterprise Basic Act, as fundamentally amended in 1999, states, "small and medium-sized enterprises are the source of dynamism of the Japanese economy." With this fundamental principle, the government has implemented numerous policies and projects for SMEs including new laws, governmental subsidies, and financial assistance.

Especially in the last few years, government policies for SMEs have largely shifted towards "improving management skills through the effective use of accounting", and, along with this, the roles of CPTAs as the experts in taxation and accounting are becoming increasingly important.

Responding to the Act for Support for Strengthening Management Functions for SMEs

On August 30, 2012, the Act for support for Strengthening Management Functions for SMEs was decreed. The purposes of the Act are (1) to recognize the financial institutions, CPTAs and firms, and other organizations that are separately approved to play a leading role in extending managerial support to SMEs, as "support institutions for management innovation" (approved support institutions) among other public supporting organizations, and support them in carrying out their activities, in order to enhance the SME's corporate management abilities, and (2) to facilitate funding operations by overseas subsidiaries of SMEs in order to promote the overseas development of SMEs. As such, it is expected to support SMEs in establishing plans for management improvements, as one of the roles of the approved support institutions.

The government has had various policy formulating tools ready to use through the activities carried out by such approved support institutions, in an aim to promote management improvements by SMEs.

The Guidelines for the Assurances to be Given by the Management requires company managers to ensure accurate grasp of financial information including business plans and their progress, and transparency of their management by disclosing such information in an appropriate and timely manner. The guidelines further state, "it is desirable to have external professionals (such as CPTAs and certified public accountants) validate the information and disclose the information and the results of the validation", from the viewpoint of enhancing the reliability of the information.

In order to live up to such expectations from society of CPTAs, TKCNF encourages the TKC members to apply for registration as an approved support institution and to engage in proactive activities as such an institution, as well as to work on the promotion and effective use of the registration so that TKC members will provide guidance for the accounting work that is consistent with the Guidelines for the Assurances to be Given by the Management.

Responding to General Accounting Standard for SMEs

General Accounting Standard for SMEs announced in February 2012 are the accounting standards, in compliance with which the approved support institutions should perform their services.

General Accounting Standard for SMEs are designed in line with the following concepts about accounting:

- It is so easy to understand and so useful in grasping the management status of the company that the managers of SMEs are willing to utilize it.

- It contributes to the provision of information to the SMEs' stakeholders, such as financial institutions, business partners, and shareholders.

- It fully takes into consideration the accounting practices in the operations of SMEs, aims to achieve harmony between accounting and taxation, and complies with the Rules of Corporate Accounting.

- It minimizes the burden for preparing such documents as financial statements, and does not impose excessive workloads upon SMEs.

The Working Group of the Discussion Meeting about Accounting in SMEs held in March 2014 confirmed that the accounting procedures conducted by SMEs in compliance with the Guidelines for SMEs are (1) necessary for SMEs to appropriately grasp the status of their management and to make appropriate managerial decisions, and (2) useful in explaining their financial information and the status of the management accurately to their stakeholders including financial institutions. The Working Group called for efforts by us, the CPTAs, for the establishment, dissemination, and utilization of the accounting procedures, stating that "it is of particular importance that all parties concerned for the support of SMEs give guidance and advice that corresponds to the actual situation of the SMEs, in order to promote the dissemination and utilization of the Guidelines for SMEs."

To live up to the expectations from society, TKCNF is improving various environments that facilitate the dissemination and utilization of the Guidelines for SMEs, as well as engaging in relevant activities in collaboration with other SMEs supporting organizations.

As a support institution for management innovation

The number of approved support institutions as of December 31, 2017 stands at 27,460, including 22,563 CPTAs and firms. That number for TKC members is 7,392, accounting for approximately 33% of the total number of CPTAs and firms.

One of the most significant roles of certified public tax accountants and firms as approved support institutions is to help SMEs establish management improvement plans. The government has been actively involved in activities focused on the promotion of management improvements of SMEs, such as developing the Support Project for Establishing Management Improvement Plans Conducted by Approved Support Institutions in March 2013, in which approved support institutions are entrusted to provide support for the establishment of management improvement plans, with the government bearing a part of the relevant expenses, with its main target set at SMEs and small businesses struggling to establish such plans on their own.

TKCNF, for its part, has set "to provide support for the survival and development of SMEs" as one of its business objectives and is acting proactively to achieve management improvements at SMEs. In addition, it has collaborated with local financial institutions with which the 20 TKC Local Associations and branches have entered into an agreement, to support clients in their management improvements and internal monitoring. In view of these activities, it is only natural that TKC members engage in support for establishing management improvement plans.

To further our efforts, we have started the 7000 Project for the Support for Establishing Management Improvement Plans for our active engagements for a period from 2014 to 2016.

The project enjoyed good evaluations, including one from the Organization for Small & Medium Enterprises and Regional Innovation, Japan, saying that "activities by TKC (the 7000 Project) served as an initiating factor" for producing achievements from the project, according to the Business Assessment Report on the SMEs Revitalization Projects Carried Out by the Approved Support Institution in Fiscal Year 2015 announced by the Organization on September 2016."

Responding to Support for the Early Drafting of Business Improvement Plans

The Small and Medium Enterprise Agency initiated its new project, Support for the Early Drafting of Business Improvement Plans in May 2017. It aims to support SMEs and small businesses in need of basic approaches to management improvements such as cash flow management and profitability management. SMEs and other companies are expected to establish, with supports by the approved support institutions, early management improvement plans including "bird's eye views of business models" and "cash flow results and plans", and submit them to financial institutions (main banks or semi-main banks), thereby making such experience an opportunity to review their future management practices.

This project has eased some conditions for its predecessor project, and is expected to be utilized by more SMEs. TKCNF has made such support activities one of the standard services to be provided by TKC members, and will commit to its performance in order to achieve the following goals:

- Certified public tax accountants will contribute to the community and society as "the experts in four fields (tax, accounting, assurance, and managerial advice)."

- Live up to the expectations from the government (Small and Medium Enterprise Agency) and the society to the approved support institutions (certified public tax accountants).

- Help strengthen the relationship of trust between clients and financial institutions.

We are committed to carrying out the sound management of SMEs, enhancing the SMEs' relationship of trust with financial institutions, and supporting SMEs for their survival and development through those activities.

Making effective use of accounting to facilitate funding for SMEs

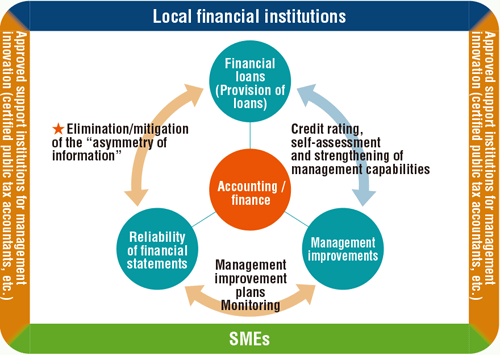

The figure on the right summarizes the interrelationship of funding activities for SMEs. The "asymmetry of information" in this figure shows the disparity in the availability of information between lenders (financial institutions) and borrowers (companies) in actual situations of funding activities. Many financial institutions cannot get sufficient information on the status of companies to which they intend to provide loans, and therefore are not able to make informed decisions about the loans. On the part of companies wishing to obtain loans, this disparity is one of the obstacles for obtaining funds smoothly.

Utilizing accounting can be a means by which to solve this problem. Dr. Ryuji Takeda, the third Chairman of TKCNF, stated about the role of the accounting, "financial statements are tables that express the true picture of a company in the form of numbers, described in the form of 'the relationships between the numbers in the statements' that represent the company."* To sum up, the role of accounting is "to grasp the true status of a company."

We are giving our suggestions to company managers that they make use of the accounting information and proactively present it to financial institutions, so that they can diminish the asymmetry of information between themselves and financial institutions, make the mutual trust solid, and represent the status of the company more accurately.

* Ryuji Takeda, Saishin Zaimushohyou Ron

(The Most Recent Theory of Financial Statements) (11th edition) published by CHUOKEIZAI-SHA, INC.

Source: Takashi Sakamoto, Keiichiro Kato

Roles of Accounting in Financial Loans to SMEs published by CHUOKEIZAI-SHA, INC.