Strengthening the management infrastructure of

TKCNF member firms

Strengthening the management infrastructure of TKCNF member firms and enhancing their quality of work are essential for ensuring the complete performance of certified public tax accountants' services and for proactively supporting SMEs for their survival and development.

Working towards the successful enhancement of the quality of work and management efficiency

It is essential to enhance the quality of work and management efficiency of tax consulting firms in order to continuously fulfill our missions, which are (1) to provide support for SMEs to ensure profits in their accounts, (2) enhancing the reliability of financial statements, and (3) establishing the unshakable basis of their survival.

Enhancing the quality of work requires "more cost and time" while enhancing the management efficiency requires "the reduction of cost and time."

We plan to solve these mutually conflicting issues by the "complete utilization of TKC systems" and "training and development of TKCNF members and their employees of the firms."

The TKC systems have been developed under the supervision and guidance by the members of the System Development Committee of the TKCNF, each of whom has profound expertise in their respective field. Enhancement of both the quality of work and of productivity will be made possible by the full utilization of the TKC systems, which are made up of the rich experiences of TKCNF members and of the know-how of excellent experts.

Establishing the system of managing tax consulting firms through the full utilization of OMS

To enable TKCNF to add more value to our services for clients while achieving efficiency, it is important for the member firms as well to utilize ICT more effectively at the levels of performance management and management strategy.

For such utilization, TKCNF is recommending the use of the Tax Accountants Office Management System (OMS Cloud) developed by the System Development Committee of TKCNF, and the use of the Field Auditing Support System that enables the auditors to use their limited hours of visit more efficiently and to secure more hours for providing managerial advice.

OMS Cloud has been developed and has evolved in such a way as to support TKC member firms for their effective utilization of TKC systems and efficient management of their firms. Its capabilities are not just the rationalization and standardization of work; they also include such functionalities as the automated recording of "the workbook processed by certified public tax accountants (transaction records)" pursuant to Articles 41 and 48-16 of the Certified Public Tax Accountant Act, and the precise capturing of information about the work performed by all employees through such functions as "confirmation of progress in field auditing", "confirmation of progress of the Continuous MAS system "confirmation of promoting self-accounting by FX2", and "confirmation of the history of practicing the attachment of documents."

Tax Accountants Office Management System

- timely capturing the entire status of the operations of a firm through synchronizing with the updated status of system utilization, thereby grasping the issues with the firm as a whole

- enabling TKCNF members to manage the progress of work by their employees based on various data and to give appropriate and prompt instructions on the basis of objective data

- grasping the outline of services provided to clients through using the Continuous MAS System and confirming the progress of field auditing

Training and developing TKCNF members and their employees through conducting seminars

For certified public tax accountants to appropriately put their social missions into practice, it is vital to enhance the overall capabilities of their firm as well as to foster the spirit of " Self-interest is in the realization of others' interest" and develop their professional skills. It is for this reason that conducting seminars has been the central focus among other activities of TKCNF.

TKCNF, in its Standards of Conduct for TKCNF members, has set the rule that "All members should hope for the clients' perpetual prosperity, commit themselves to the perfect performance of their services, and endeavor to constantly develop their highly professional skills throughout life", requiring them to participate in the life-long seminar with 90 hours of sessions for the first year and 54 hours for the following years. This seminar is considered the most important of all, as it equips all TKC members with sufficient professional skills and lets them maintain their professional ethics as TKCNF members.

In 2010, TKCNF opened the TKCNF Iidabashi Studio that provides such capabilities of recording seminars in high quality and definition and timely delivering of the videos to the member firms leveraging on-demand transmission technology, for the purpose of stepping up and expanding the system of conducting seminars for TKCNF members and their employees. This makes it possible for all TKC member firms to participate in the seminars conducted by the leading lecturers in Japan, within their own locations.

It is our duty to make full use of the learned expertise in our practice of field auditing and utilization of TKC systems, for the survival of our clients, the continuous achievement of profits in their financial statements, and the appropriate fi ling of their corporate tax returns.

Aiming to step up the practical abilities that get the jobs done

Enhancing the overall capabilities of tax consulting firms cannot be done without improving the employees' ability to conduct field auditing. With this in mind, TKCNF has been developing established the employee training system since April 1985.

In April 2012, the Training for Senior Employees previously conducted was upgraded to the Field Auditor qualification system as part of the system, with the aim to enhance employees' ability to conduct field auditing. And starting in 2016, the qualification system for Assistant Field Auditor has been in place and employees are being encouraged to acquire the qualification in a proactive manner.

The purpose of establishing these qualification systems is to support TKCNF member firms in the fields of taxation and accounting, so that they practice the attachment of documents by preparing true and accurate tax returns of their clients through conducting field auditing, providing services that satisfy the needs of their clients ,and thereby carrying out self-support management by SMEs across Japan, these being supporting structures of the Japanese economy.

Increasing the TKCNF members with the badge

TKCNF provides the TKCNF Badges to some members in appreciation of their proactive practice of the principles and policies of TKCNF, such as the high ratio of carrying out next-month field auditing, "support for drafting of management improvement plans by the Continuous MAS System", "support for self-accounting through FX2", "practicing the attachment of documents, etc., prescribed in Item 1, Article 33-2, paragraph 1 of the Certified Public Tax Accountant Act", and "completion of the 54-hour life-long learning seminar."

This aims to give advice to those members not yet reaching the required levels, enhance the quality of work by TKCNF members, and raise the level of services by TKCNF member firms as a whole.

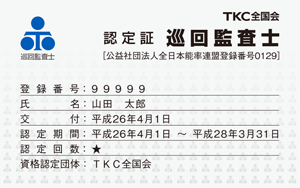

About the Field Auditor and Assistant Field Auditor

Field Auditor and Assistant Field Auditor are the qualifications given to employees of the TKCNF member firms who support the quality of work performed by the firm, registered with the All Japan Federation of Management Organizations (certification numbers 129 and 133), the most authoritative of all qualification certifying private organizations in Japan in the field of consultancy.

This qualification is given to employees who have participated in seminars for advanced expert knowledge and ethics about professional ethics, taxation laws, legal practices, accounting, management consultancy, and such taxation systems as corporation tax, consumption tax, and personal income tax, each of which is conducted as part of the employee training programs, and passed the examination for the Field Auditor on such subjects. Field Auditors and Assistant Field Auditors are greatly expected to make plenty of contributions to the activities for promoting KFS and dissemination of the General Accounting Standard for SMEs, and to act at every workplace as persons in charge of supporting management improvement operations by the support institutions for management improvement in accordance with the Act on Support for Strengthening Management Functions for SMEs.