What TKC now seeks to achieve

The Purpose of establishing TKCNF and the concrete steps to be taken toward its 50th anniversary in 2021

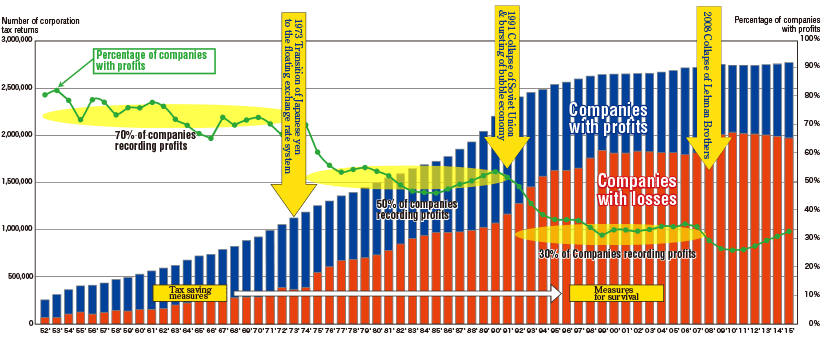

Performance trends of SMEs

The chart below shows the proportion of Japanese companies filing their corporate income tax returns stating either profits or losses, according to the statistics of the National Tax Agency ("50 years of the National Tax Agency"). A closer look at the transition of the proportion of the companies with profits reveals the following facts.

- 1952 - around 1974 The period when approximately 70% of SMEs filed their tax returns stating profits

- 1975 - around 1992 The period when approximately 50% of SMEs filed their tax returns stating profits

- 1993 and later The period when approximately 30% of SMEs filed their tax returns stating profits

The TKC National Meeting of Executives in 2017

This data represents all companies in Japan and, at the same time, shows the status of performance at SMEs, because 99% of companies in Japan are SMEs. The fact is that approximately 70% of companies recorded profits during 30 years after the Second World War, but this situation reversed in the 1990s when about 70% of them now recorded losses. The first turning point in history was "the transition of the Japanese yen onto the floating exchange rate system" in 1973, and the second one was "the bursting of the bubble economy" and "the end of the Cold War with the collapse of the Soviet Union", both of which occurred in 1991. Further, the great financial crisis after "the collapse of Lehman Brothers" in 2008 is believed to have intensified the increase in the number of companies recording losses.

The latest announcement in September 2016 by the National Tax Agency on its website shows that the percentage of companies filing statements showing profits is 32% of all companies in the 2015 accounting period, an increase of 1.5 percentage points from the previous period. Although the percentage has been rising for five consecutive years from 25.2% in the 2010 accounting period, the lowest number of all time, approximately 70% of them still record losses.

These trends in the performance of companies have caused the greatest change in what is required of tax consulting firms.

Changes in the needs for tax consulting firms

From the 1950s to the mid-1970s, when approximately 70% of companies recorded profits, the needs centered on tax reduction measures. Tax consulting firms helped companies a great deal per forming "the delegated bookkeeping work" in accordance with the blue return system of corporation tax. However, as 70% of them were then recording losses in the 1990s, the greatest contributions to SMEs by tax consulting firms came to be "support for achieving profits in financial statements" and "appropriate corporation tax returns." In the meantime, advances in IT technology have made low-cost cloud-based accounting software more widely used, leading to the environment where SMEs are able to do the bookkeeping by themselves with ease. As such, tax consulting firms cannot make contributions to SMEs merely by performing "the delegated bookkeeping tasks."

SMEs are now seriously seeking management strategies that make their financial statements continuously show profits, for their survival. It is our duty as certified public tax accountants to respond to these needs in an appropriate manner.

Purpose of establishing TKCNF

The purpose of establishing TKCNF is stated in the Standards of Conduct for TKC Accountants, as follows:

Today SMEs, which support the Japanese economy, are still exposed to harsh economic environments and we are still in a half-way position on the path to achieving the purpose of establishing TKCNF.

On the other hand, society's expectations for us, certified public tax accountants, as supporters of the SMEs have grown ever greater. We are required to proactively fulfill our role as "the supporters for SMEs", living up to the expectations and ultimately carrying out our purpose of establishing TKCNF.

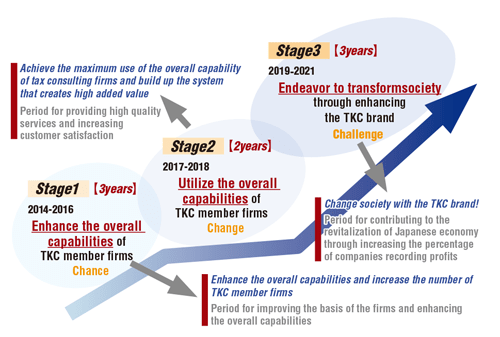

The roadmap to the achievement of our strategic targets

To proactively live up to the expectations from society, TKCNF established the unified action theme as follows, at the TKC National Federation Policy Presentation held on January 17, 2014, announcing its roadmap to the achievement of policy agenda and strategic targets.

Create our future. The new growth strategy 2021 for TKC accountants!

The roadmap has three stages in the period until 2021, the 50th year from its establishment, engaging TKCNF in proactive activities.

- Stage 1 "Chance" 2014-2016

Enhance the overall capabilities and increase the number of TKC member firms - Stage 2 "Change" 2017-2018

Achieve the maximum use of the overall capability of tax consulting firms and build up a system that creates high value added - Stage 3 "Challenge" 2019-2021

Change society with the TKC brand!

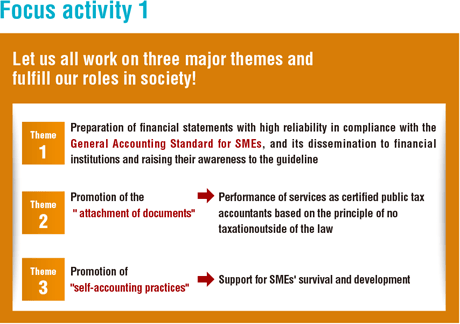

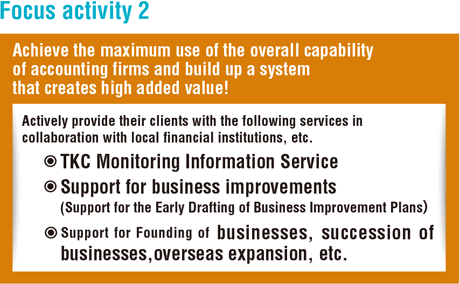

Policies for the activities in Stage 2

In Stage 2 from 2017 to 2018, we will commit ourselves to two focus activities of "commit ourselves to three major themes and fulfill our roles in society!" and "achieve the maximum use of the overall capability of tax consulting firms and build up the system that creates high added value!"

Policies for the activities of TKCNF

We are committed to living up to the expectations of society from the certified public tax accountants through our activities as supporters of SMEs, thereby contributing to the development of the Japanese economy.