Enhancing the reliability of financial statements and strengthening collaboration with financial institutions

We, the TKC members, contribute to the sound development of SMEs, by ensuring complete submission of supporting documents, field auditing, and endeavoring to prepare highly reliable financial statements in compliance with the General Accounting Standard for SMEs, and by strengthening the capabilities of company managers in financial management.

CPTAs are required by Article 45 of the Certified Public Tax Accountant Act to perform their services based on "the true facts." We, CPTAs, wishing for the sound development of SMEs in Japan, must commit ourselves to our missions including "complete execution of field auditing", "expansion of the 'supporting document submission' pursuant to Article 33-2 of the Certified Public Tax Accountant Act", "attachment of 'Certificate of Bookkeeping Timeliness' for financial statements and its disclosure", and "dissemination of the system for accounting advisors."

Field auditing ensures the reliability of financial statements

As standards for professional practices for TKCNF members, all members are required to perform field auditing and fulfill the obligations pursuant to Article 45 of the Certified Public Tax Accountant Act by submitting all necessary supporting documents. This assures that they have met the expectations to earn societies trust.

The Standards of Conduct for TKC members prescribes the following, regarding field auditing and the practice of submission of supporting documents:

Field auditing

The term "field auditing" means to actually visit every client, each month and at the time of year-end account closing, to confirm the truthfulness, existence, and completeness of the facts on which the accounting is based, in order to ensure the legality, accuracy, and timeliness of the accounting materials and records, and to give relevant guidance. In conducting field audits, efforts should be made to examine the soundness of management principles.

Field auditing has two types; one is the monthly field audit conducted every month, and the other is the account-closing field audit conducted at the year-end account closing.

The late Dr. Ryuji Takeda, former Professor Emeritus of Kobe University and the third Chairman of TKCNF, wrote about field audits, that "certified public tax accountants should visit their clients on a monthly basis, check the status of practicing account processing on site, rectify any incompleteness, and give guidance" in his book Saishin Zaimushohyou Ron (The Most Recent Theory of Financial Statements (11th edition) published by CHUOKEIZAI-SHA, INC.

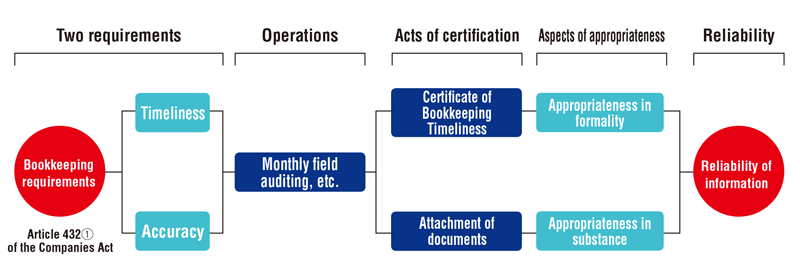

He further stated that, as a "means (operations)" for fulfilling the "bookkeeping requirements" (timeliness and accuracy) stipulated in Article 432, paragraph 1 of Companies Act, "recording of transactions (accounting books) conducted by clients themselves, and monthly field audits conducted by CPTAs to endorse the 'reliability of the bookkeeping' from a viewpoint of a third party and their confirmation of the reliability of the bookkeeping" can take the place of the internal controls conducted by large-scale enterprises (as illustrated below).

Source: Ryuji Takeda, Saishin Zaimushohyou Ron (The Most Recent Theory of Financial Statements),

11th edition, published by CHUOKEIZAI-SHA, INC.

About the submission of supporting documents, the Standards define its significance as follows:

What it means to submit supporting documents

The system of submission of supporting documents is an embodiment by actual practice of the missions of CPTAs for the benefit of the general public, which is to ensure, pursuant to Article 33-2 of the Certified Public Tax Accountant Act (submission of written documents containing calculations and examinations), the appropriate fulfillment of the obligation to pay taxes from a fair and independent standpoint as stipulated in Article 1 of the Act.

All members must perform field auditing in an aim to completely perform the services of CPTAs, and proactively submit the documents as stipulated by Article 33-2, paragraph 1 of the Certified Public Tax Accountant Act to the tax return, as proof of having fulfilled the due care and diligence pursuant to the Act.

In the system of submitting supporting documents, CPTAs attach the documents that clarify the "items they have calculated, organized, or for which they have been consulted" and "make the statement about the appropriateness of the tax returns" in their preparation of tax returns (tax documents), pursuant to Article 33-2 of the Certified Public Tax Accountant Act.

The objective is to testify that CPTAs, in the course of preparing a tax return, have fulfilled their duties of ensuring a high level of care from a fair and independent standpoint, and of sincerity and fidelity (accountability), in accordance with applicable taxation laws and regulations. Therefore, any false or fraudulent statement will lead to disciplinary potential.

If such tax audit reports are submitted, a relevant tax office must give the CPTA acting on behalf of the taxpayer an opportunity to make statements of opinions prior to notifying the taxpayer of the tax investigation, pursuant to Article 35, paragraph 1 of the Certified Public Tax Accountant Act. If the statement of opinions clarifies the doubts and questions, the office issues "notice on the results of the hearing of opinions" to the CPTA.

The tax returns with such attached documents submitted and the underlying financial statements will have extremely high reliability.

The Certificate of Bookkeeping Timeliness evidencing the timeliness of bookkeeping

TKC members provide their clients with the Certificate of Bookkeeping Timeliness (certificate of the timeliness in preparing accounting books (Article 432 of the Companies Act) and certificate of electronic filing of the tax return), as the documents which provide objective evidence of the actual practice of field auditing.

This is to help facilitate the client's funding activities by certifying the following items about the client's preparation of their accounting books, financial statements, and corporate income tax return:

- Their accounting books are prepared in a timely manner pursuant to Article 432 of the Companies Act.

- The TKC member has visited the client monthly to conduct field auditing and completed the monthly closing of accounts.

- All items in the financial statements completely coincide with the account balance of the corresponding chart of accounts, and no items are independently prepared.

- The corporate income tax return has been prepared based on the financial statements and filed electronically by the due date.

The Certificate of Bookkeeping Timeliness is issued utilizing the benefit of the TKC Financial Accounting System which disallows any retroactive processing (i.e. correction, addition, or deletion) of past accounting data, and has the unique value of allowing the TKC Corporation, a third party, to certify the timeliness in the preparation of the accounting books, financial statements, and corporate income tax returns, as well as their accuracy in calculation.

Dr. Takeda wrote, in his fore mentioned book, "the information that is verified monthly (monthly closing of accounts) is delivered to an information processing center, a third party, for its control. When financial statements are prepared based on the information stored under such controls, the reliability of the statements significantly increases. This practice of storage and control proves to a third party that no past data recorded about results has been 'manipulated' or 'falsified' through any processing including corrections, additions, or deletions."

This Certificate of Bookkeeping Timeliness has drawn attention from financial institutions across Japan, leading to the release of financial instruments that place importance on the reliability of financial statements prepared by TKC members and that utilize the Certificate of Bookkeeping Timeliness in setting the conditions for loans and preferential interest rates.

Collaborating with financial institutions for providing management support

Offering the TKC Monitoring Information Service

The TKC Monitoring Information Service is a service in which a TKC member, upon request by a client, timely provides financial institutions with financial data, the reliability of which is secured by the monthly field auditing by the member, so that the member can provide management support to the client in collaboration with the financial institutions.

This service consists of the following three components:

- Provision of Financial Statements, etc.

- Provision of Monthly Trial Balance Sheets

- Online disclosure of updated performance data (under development)

What financial institutions say....

- We can now have a more fruitful interview with the President, because we can confirm the financial statements in advance.

- Receiving the trial balance sheets monthly has enabled us to propose and provide loans in a timely manner.

- Using this service will make it possible to focus more on extending financial supports. I want more clients to use this. We can now have a more fruitful interview with the President.

What company managers say...

- Copying and sending the financial statements and other paperwork is no longer needed for submission to financial institutions.Its all automatic.

- We could obtain loans smoothly and with favorable conditions.

- We feel secure because we can choose by ourselves what information is to be provided.