Approaches Made by the Accounting Firm Business Division

Aiming to realize “positive balances” and “proper filing” together with TKC member firms

The Accounting Firm Business Division is engaged in its business activities in close collaboration with the TKC National Federation (TKCNF) organized by our customers of 11,500 certified public tax accountants and certified public accountants (“TKC Members”) based on one of TKC’s business objectives stipulated in its Articles of Incorporation (Article 2, Paragraph 1: Management of the electronic data processing centers to defend the business domain and maintain control over the fate of accounting firms).

Our relationship with the TKC National Federation (TKCNF)

*For details about the TKC National Federation, please refer to

"All About the TKC National Federation."

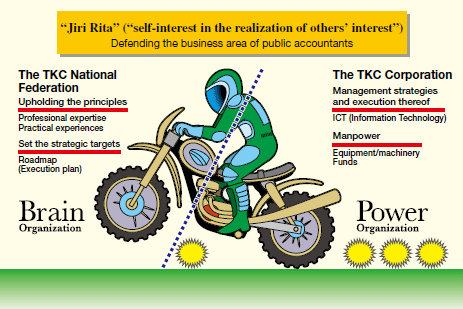

The relationship between TKC and TKCNF can be compared to the two wheels (front wheel and rear wheel) of a vehicle (see illustration). TKCNF, the front wheel, has the role of upholding the principles of professional tax consultants and setting the goals for its business activities, or giving the direction to go forward; and TKC, the rear wheel, serves to develop the management strategies to achieve the goals and to input the manpower to each of them.

What operates as the joint between them is the concept, Jiri Rita (self-interest is in the realization of others’ interest) (see Page 3), which is TKC’s company motto as well as the basic principle of TKCNF. TKC’s business objective to defend the business domain and maintain control over the fate of accounting firms guides the Company in the right direction.

Environment Surrounding SMEs and the Activities of TKCNF

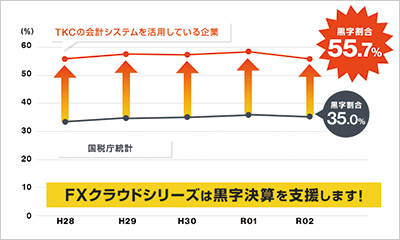

According to the Outline of Filing of Corporate Income Tax Returns (Taxation) published by the National Tax Agency in November 2021, the percentage of companies recording profit in FY2020 was 35.0%. This is a decrease of 0.3% from the previous fiscal year, and shows that 65% of companies are recording losses.

According to TKC Management Indicators (BAST) (see Page 27) for 2021, which contains analysis on the performance and financial standing of SMEs, the average revenue for companies across all industries in 2020, in part due to the impact of COVID-19, decreased 7.121 million yen from the previous year (average revenues fell to 96.9% of previous year values). With the exception of the construction industry, all industries suffered a decrease in year-on-year revenues; the lodging industry and food and drink service industry recorded the greatest decreases, with average revenues falling to 89.5% of previous year values. Evidently, the management environment for SMEs is growing in severity.

In such a climate, member firms of the TKCNF, in an aim to achieve positive balance and proper filing, conducted monthly field audits and monthly settlements, offered managerial advisory services, and undertook activities to “strengthen the company through accounting.” As a result of these activities, 55.7% of the clients of TKC member firms using TKC’s financial accounting systems have achieved a surplus, and there are rising expectations from SMEs and financial institutions nationwide towards the effective instructions provided by TKC member firms.

Initiatives Aimed at Achieving a Positive Balance

TKC is working on the development and provision of the following services and systems to support the continued development of TKC member firms and their clients:

Helping to enhance TKC members' capabilities for giving accounting guidance

Amid a challenging business environment in which 65% of companies are recording deficits, shifting the bottom line of financial statements from deficit to surplus is the biggest issue for SMEs. To solve this, companies must clarify their management vision and develop their business plan.

TKC offers the Continuous MAS System as a system for helping TKC Members develop business plans and business improvement plans of their clients. The Continuous MAS System is utilized as a tool to help develop a medium-term business plan based on management’s visions and a fiscal year budget to manage the performance of the following business year, as well as to enable the PDCA cycle and the system for performance management to take root within their clients.

TKCNF encourages TKC Members to practice both support for the development of business improvement plans and support for early drafting of business improvement plans (also known as the Post-COVID Sustainable Development Plan Project), which are promoted by the Small and Medium Enterprise Agency, as official support institutions for management innovation (approved support institutions) (*1); the Continuous MAS System is a specific tool to enforce such practices.

*1 The SME Business Capabilities Enhancement Support Act, which was enacted in August 2012, recognizes certified public tax accountants, tax accountants offices and other organizations as the official support institutions for management innovation (approved support institutions), and tasks them with the provision of support for strengthening the management functions of SMEs.

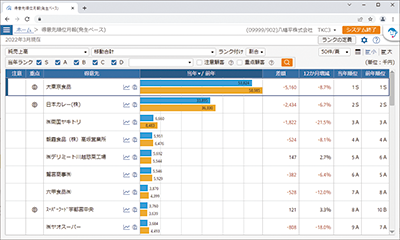

Helping management in making appropriate decisions

TKC offers the Integrated Accounting Information System (FX4 Cloud) and the FX Cloud Series (FX2 Cloud and FX Meister Cloud) as financial accounting systems for clients, which help management to grasp their company’s financial results in a timely manner and make appropriate decisions under the guidance provided by certified public tax accountants, experts in accounting and taxation. The FX Cloud Series, which TKC began offering in September 2020, features functions to “strengthen the company through accounting” which provide enhanced support for management in their strategic decision-making and allow them to check the latest results across the company anytime, in less than 3 seconds. Also, in September 2020, TKC began offering a cloud-based financial accounting system, FX Cloud Series (FX2 Cloud, FX Meister Cloud). This system features functions to “strengthen the company through accounting” which provide enhanced support for management in their strategic decision-making and allow them to check the latest results across the company anytime, in less than 3 seconds. The key to strengthening the company is to increase its marginal profit (gross profit), ensure appropriate labor share, and increase capital-to-asset ratio. Moreover, the company can become even stronger by checking its performance by segment and by account. The FX Cloud Series offers a suite of functions to allow just that.

FX2 Cloud

Initiatives Aimed at Achieving Proper Filing

Helping to enhance the reliability of financial statements

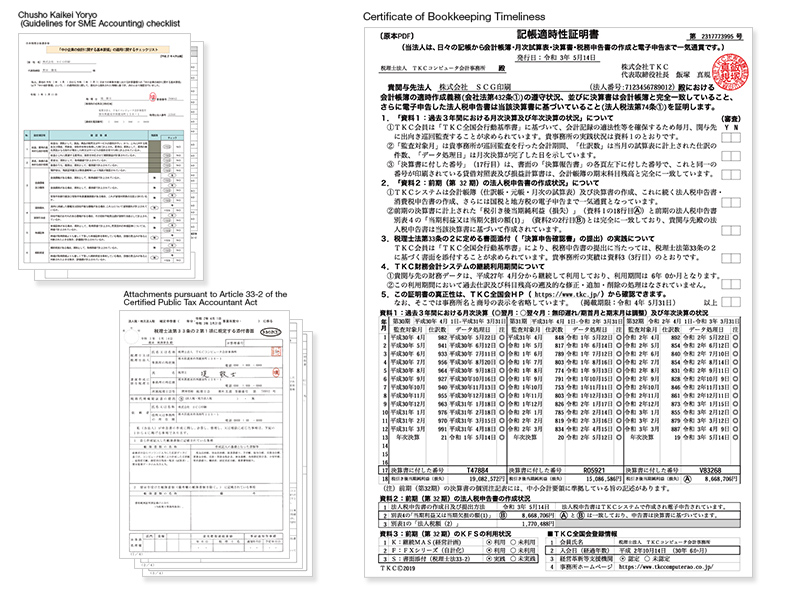

The most significant benefit of the financial accounting system offered by TKC is that it allows no retrospective correction or addition/subtraction processing (corrections, additions, or deletions) to any transaction data during an accounting period once the field audit is completed, based on the field audits every month and at the time of the year-end account closing (*2) and on the monthly settlements that TKC member firms conduct for their clients. Leveraging this benefit, TKC issues the Certificate of Bookkeeping Timeliness (certificate of timeliness in preparing accounting books (Article 432 of the Companies Act) and certificate of electronic filing of the tax return) for the purpose of contributing to smooth funding activities by the clients.

In this practice, TKC Corporation certifies as a third party that all accounting processes, all the way from monthly closing to year-end closing and electronic filing of tax returns have been timely completed and that tax returns are prepared in a consistent manner from accounting evidence to income tax returns, while TKC Members visit their clients on a monthly basis to providetimely guidance for accurate bookkeeping (field auditing). The Certificate of Bookkeeping Timeliness is acclaimed by financial institutions across Japan, leading to the release of various financial instruments with the conditions on loans and preferential interest rates based on this certification.

In addition to this Certificate of Bookkeeping Timeliness, the reliability of financial statements prepared by TKC Members can also be verified by Shomen-tempu (attachment of tax audit reports) and the Chusho Kaikei Yoryo (Guidelines for SME Accounting) checklist.

Shomen-tempu is a system in which a tax accountant submits a document, as an attachment to the tax return, indicating the items that the tax accountant calculated, prepared, and/or advised in person for the filing of tax return of his/her client pursuant to Article 33-2 of the Certified Public Tax Accountant Act. The purpose of the system is to demonstrate that the tax accountant has performed high duty of care as an independent and fair party pursuant to the taxation laws and regulations, and that he/she has further exercised duty of integrity and duty of loyalty (accountability) in preparing the tax returns. While the Shomen-tempu is an indirect measure, it is considered to be the only system to have a legal basis in verifying the reliability of the financial statements of SMEs.

The other document, Chusho Kaikei Yoryo checklist serves to confirm compliance with the Basic Guidelines with Respect to the Accounting Procedures at Small and Medium-sized Enterprises (the Chusho Kaikei Yoryo). The Guidelines were formulated in 2012 as a set of simple accounting rules that can also be used by SMEs. TKC Members are mandated to provide guidance on the accounting process in accordance with the Guidelines in their field audits.

*2 The term “field auditing” means to actually visit every client each month and at the time of year-end account closing, to confirm the truthfulness, existence, and completeness of the facts on which the accounting is based, in order to ensure the legality, accuracy, and timeliness of the accounting materials and records, and to give relevant guidance. In conducting field auditing, efforts should be made to examine the soundness of management principles. Field auditing has two types: one is the monthly field auditing conducted every month, and the other is the account-closing field auditing conducted at the time of year-end account closing.

(Provisions for the Practices in Chapter 3 of the Standards of Conduct for TKC Members by the TKC National Federation)

Retention of Clients of TKC Members in Good-standing and Support for Increasing the Number of Clients

Promoting the accounting systems for medium-sized companies

TKC offers the Integrated Accounting Information System (FX4 Cloud) for medium-sized companies with annual turnover from 500 million to 5 billion yen, with an aim to retain the clients of TKC Members in good-standing and increase the number of larger clients. A significant benefit of FX4 Cloud is that the system offers a variety of functions that enhance compatibility between the accounting works of the company and the field audits conducted by TKC Members, including: performance management by business division in which the user can configure the business division layers; journal entry templates that allow easy data sharing with other business systems; and management report design tools for companies to formulate customized management reports.

Promoting the accounting systems for non-profit organizations

Today, an increasing number of social welfare corporations, public interest corporations, hospitals and clinics are revising or reviewing their accounting principles or policies in response to the changes in legal and social systems. The TKC National Federation (TKCNF) has organized a research council consisting of TKC Members with expertise in accounting and taxation of this sector in order to help organizations adapt to such changes in the social system and is actively supporting the efforts to improve their management.

TKC, for its part, offers services such as the FX4 Cloud (for the accounting of social welfare corporations), the FX4 Cloud (for the accounting of public interest corporations), and the Financial System for Medical Institutions (MX3 Cloud/MX2) to support these activities.

Helping Accounting Firms to Stay Compliant with Laws

Accounting firms are required to operate in strict compliance with laws and regulations, including the full implementation of monthly field auditing and practicing the attachment of tax audit reports pursuant to Article 33-2 of the Certified Public Tax Accountant Act as well as obligations to prepare transaction records (Article 41 of the Act) and supervision obligation over employees, etc. (Article 41-2 of the Act).

To ensure compliance, TKC offers the Tax Accountants Office Management System (OMS Cloud) which interacts with the Corporate Financial Reporting System (TPS1000), the Field Auditing Support System and other systems from TKC and automatically generate the transaction records.

TKC's Approach to FinTech Services

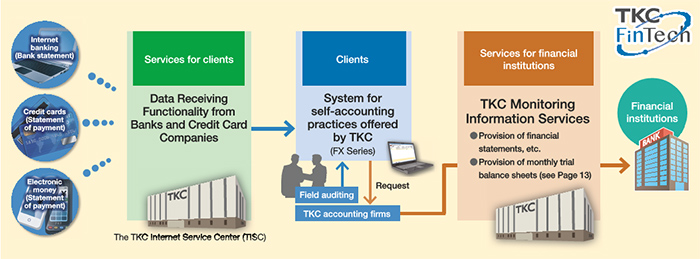

Offering Data Receiving Functionality from Banks and Credit Card Companies

TKC offers a functionality to receive data from banks and credit card companies incorporated in the FX Series as part of the FinTech services it offers to clients.

In recent years, more and more cloud-type accounting software products have the data aggregation function, in which they receive transaction data from the accounts at financial institutions through the Internet and automatically convert them into accounting data. These functions are highly effective in reducing the clients’ accounting workloads. However, they must be used with care in cases where one transaction involves multiple financial institutions, such as inter-bank transactions or payments by credit card, because there is a risk that the same transaction data may be recorded redundantly and entered into the journal more than once. The data receiving functionality from banks and credit card companies offered by TKC automatically collects detailed transaction data from financial institutions via the Internet; based both on TKC’s proprietary method for avoiding duplicate entries and on TKC Members’ monthly field audits, it achieves timely and accurate journal entries while increasing efficiency in bookkeeping operations.

Offering the Local Benchmark Cloud

TKC offers the Local Benchmark Cloud for the purpose of enhancing the management capabilities of the clients of TKC member firms and strengthening the relationship of mutual trust between the clients and financial institutions. It is a service that automatically generates, from the financial data accumulated in the TKC Internet Service Center (the data center of TKC), financial information (six indexes) that the Ministry of Economy, Trade and Industry indicates as a tool to grasp the financial status of a company, and non-financial information (four perspectives) from the insights obtained by TKC member firms through interviews with their clients. The benchmarks generated in this service are provided, with the approval of management, to financial institutions by TKC Members through the TKC Monitoring Information Service.

Supporting Complete Compliance with the Electronic Books Maintenance Act

An ad run in the morning edition

of the Nihon Keizai Shimbun

on December 7, 2021

On March 29, 2019, TKC became the first among its competitors to acquire the certification under the Electronic Books Software Legal Compliance Certification by Japan Image and Information Management Association (JIIMA) for the financial accounting systems (FX2, FX4 Cloud, e21-Meister, etc.) that are offered to the clients of accounting firms.

This is a system under which JIIMA checks whether a commercial software for the bookkeeping and recording for national taxes comply with the requirements of the Electronic Books Maintenance Act (*3), and issues a certificate for those that meet the legal requirements. Companies that implement a certified accounting software do not have to check whether it meets the requirements of the Electronic Books Maintenance Act or other tax laws and has the assurance of being in compliance with the Act.

The requirements for the retention of electronic books have been eased in the Revised Electronic Books Maintenance Act of Japan, which was enacted on January 1, 2022. There are now two types of electronic books, which are electromagnetic records of national tax-related books: (a) “superior electronic books” that contain the history of additions, deletions, and revisions to the accounting data (traceable) (electronic books that satisfy the requirements of Article 2 and Article 5 of the Ordinance for Enforcement of the revised Act); and (b) “other electronic books” that are prepared using accounting software that do not keep record of such additions/deletions/revisions (electronic books that satisfy only the requirements of Article 2 of the Ordinance for Enforcement of the revised Act). “Superior electronic books” are required to contain a history of the additions, deletions, and revisions to accounting data. TKC supports the implementation of its FX Cloud Series, which creates “superior electronic books,” on a national scale.

The Revised Electronic Books Maintenance Act of Japan also mandates the electronic retention of electromagnetic transaction data (PDFs and other files of invoices and receipts received from customers via the Internet); records in paper form will no longer be recognized as official tax-related documents (*4). The Revised Consumption Tax Act will also come into force on October 1, 2023, and all business operators will be required to implement a qualified invoice preservation system (invoice system). TKC supports the implementation of systems that are fully compliant with the above legal revisions.

*3 The Electronic Book Maintenance Act permits companies filing blue income tax returns to preserve tax-related books and documents that must be stored for up to 10 years in the form of electromagnetic data instead of papers.

*4 Under the FY2022 Tax Reforms, a safe harbor rule has been established that runs from January 1, 2022, to December 31, 2023.

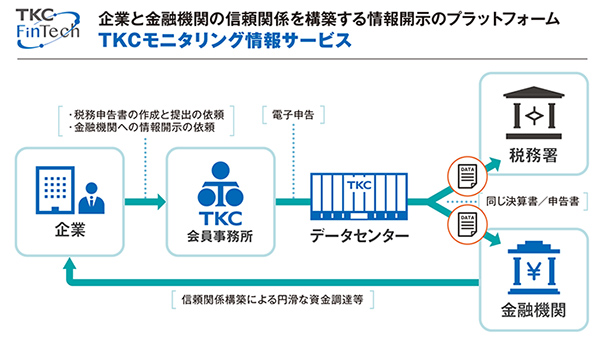

TKC Monitoring Information Services to Support Financial Institutions and SMEs

Banks are having difficulty making appropriate financing decisions due to lack of information on the business performance of their business customers. Many financial institutions face similar issues. To resolve and reduce this asymmetry of information in SME financing, TKC offers TKC Monitoring Information Services (*5) as part of its FinTech services for financial institutions.

TKC Monitoring Information Services provide financial information free of charge to financial institutions via the Internet. When requested by clients (including private businesses), TKC member firms provide financial information such as monthly trial balance sheets and financial statements that have been prepared after monthly field audits and monthly settlements. Monthly trial balance sheets will be made available immediately upon completion of the monthly settlements, and financial statements are disclosed immediately after the client electronically files its financial documents to the tax authorities. Because the same data as those filed to the tax office is automatically disclosed to financial institutions, the information cannot be tampered. This leads to high rating by financial institutions as a service where they are “able to obtain highly reliable financial information.”

TKC Monitoring Information Services consist of the following two services:

1. Provision of financial statements, etc.

A service in which TKCNF Members, upon request by their clients, disclose to financial institutions the company’s financial statements and tax return data immediately after the electronic tax filings of corporate tax returns.

2. Provision of monthly trial balance sheets

A service in which TKCNF Members, upon request by their clients, provide to financial institutions such data as monthly trial balance sheets upon completion of the monthly settlements conducted by TKC member firms.

●The number of companies adopting the Services exceeds 300,000

TKC began offering the Monitoring Information Services in October 2016. The Services have increased their user base and are now adopted by more than 471 financial institutions nationwide and used to make financing decisions by all mega-banks, and by more than 90% of regional banks, second-tier regional banks, and credit associations.

Also, among them, some financial institutions offer companies using the TKC Monitoring Information Services special benefits such as preferential interest rates, short-term continuous lending, and exempting management from personal guarantees, leading to the development of unique financial instruments.

Against such a backdrop, the number of companies adopting TKC Monitoring Information Services has been increasing steadily and, as of March 2022, exceeds 300,000. Through the use of the Services, SMEs can enjoy various benefits: there is no need to produce copies or mail in the financial statements to the financial institution; the financing examination goes faster with a speedy submission of financial statements data; and companies receive higher evaluation from financial institutions by submitting highly reliable financial statements.

By using the TKC Monitoring Information Services, SMEs can further strengthen their relationships with financial institutions. Expectations of financial institutions are rising for accounting firms that support the preparation of highly reliable financial statements. The TKC Monitoring Information Services provide platform for information disclosure on which to build trilateral trust between SMEs, financial institutions and accounting firms.

*5 The TKC Monitoring Information Services acquired the patent related to network authentication (Patent No. 6375425) in July 2018, and the patent related to a mechanism to provide monthly trial balance data and financial statement data (Patent No. 6419378) in October 2018.