Approaches Made by the Enterprise Information Systems Sales Headquarters

Helping Large-sized Companies Solve Issues Regarding Taxation and Accounting

The Enterprise Information Systems Sales Headquarters offers taxation and accounting systems to the market of large-sized, mainly listed companies to support the compliance and streamlining of corporate groups in their taxation and accounting tasks, and is actively engaged in activities to making such companies and their affiliates the clients of TKC Members.

The Environment Surrounding the Market of Large-sized Companies

Under the FY2020 Tax Reform Outline (the Liberal Democratic Party, Komeito) and the Law for Partial Revisions to the Income Tax Act, etc. (Law No. 8 of 2020), the current consolidated taxation system was revised from the business year beginning April 1, 2022, and switched to a group tax sharing system. Based on these revisions, the Accounting Standards Board of Japan has indicated that the Practical Solution on the Accounting and Disclosure Under the Group Tax Sharing System (Practical Solution No. 42) will be applied from the business year beginning April 1, 2022. In addition, the FY2021 Tax Reform Outline (the Liberal Democratic Party, Komeito), introduced the Revised Electronic Books Maintenance Act, easing requirements for the retention of electronic books, and mandating the electronic retention of electromagnetic transaction data. This is expected to result in increasing needs for storing accounting evidence in electronic form and companies are further required to cope with such series of law amendments and system reforms.

In addition, companies expanding internationally as part of their group’s growth strategy are facing pressing needs to strengthen the system for the management of their group including overseas subsidiaries, the issues of which include ensuring appropriateness, accuracy and promptness of overseas subsidiaries’ financial information, and controlling the risk of potential fraud.

Adopted by More than 91% of the 100 Largest Japanese Companies by Revenue

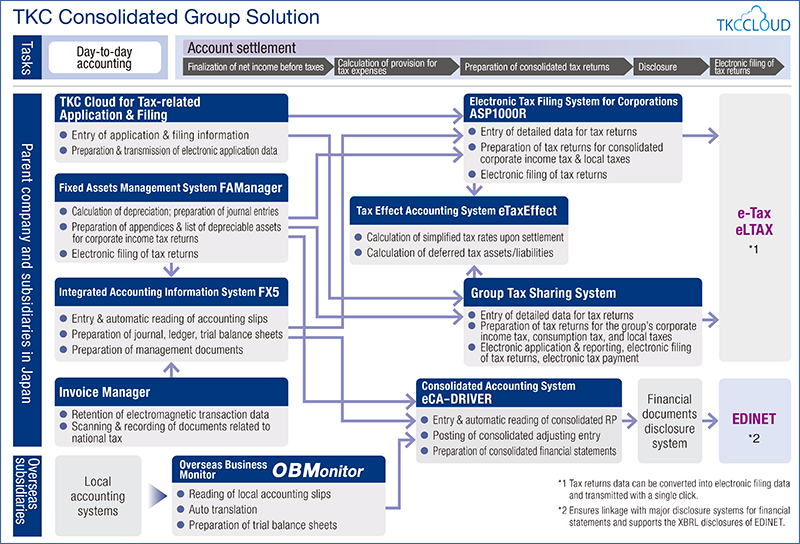

Keeping in line with such changes in the market and the increasing needs for the digitalization, timeliness, and accuracy of accounting and financial management systems among corporate groups, TKC offers large-sized companies the TKC Consolidated Group Solution (as illustrated) that encompasses group tax sharing payments, non-consolidated tax payments, electronic filing of tax returns, tax effect accounting, consolidated and non-consolidated settlements, management of fixed assets, management of overseas subsidiaries, etc. These solutions have been developed by leveraging TKC’s strengths gained through its focused efforts on the development of taxation and accounting systems since its foundation. Customers can manage the data from each group company in a secure manner and with unitary control and minimal costs, which is made possible by TKC providing the solutions as a cloud-based service from the TKC Internet Service Center.

The most significant benefit of TKC’s solutions is that TKC members, experts in actual practices of taxation and accounting, provide not only systems and services but also intensive support “from implementation of system to actual operation” with great care and attention through a nation-wide network, and they help groups of companies achieve lawful and appropriate tax returns and account processing.

TKC is committed to actively helping large-sized companies manage their groups by providing services with high added value from the implementation of the system to its actual operation in close collaboration with the TKCNF’s Medium- and Large-sized Companies Support Council and Overseas Business Support Council, and by leveraging the high quality of work in taxation and accounting which TKC Members are capable of performing.

Reliable Support Structure for Customers

- 1. Disseminating updated information

- TKC issues "TKC Express", e-mail publications that deliver timely updated information about amendments to accounting and tax legislation relating to large-sized companies, and a "WEB Column" in which members of the TKC National Federation Medium- and Large-sized Companies Support Council give explanations about the latest trends in accounting and taxation.

- 2. Organizing seminars and workshops

- TKC organizes seminars on the latest topics in taxation and accounting as well as various courses for continuous upgrading of skills of the accounting personnel and for newly appointed personnel, given by experts and knowledgeable persons on an ad-hoc basis.